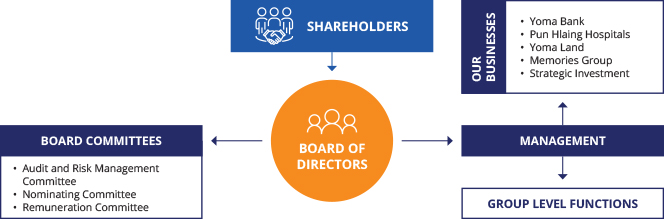

FMI’s Corporate Governance Framework

First Myanmar Investment Public Company Limited (the “Company”, and collectively with its subsidiaries, the “Group”) is committed to good corporate governance and managing its affairs in a fair and transparent manner to create long-term sustainable value for its shareholders and the wider community through ethical and responsible business practices. The Company’s benchmark of governance remains rooted in its Corporate Governance Manual (the “CG Manual”) and corporate policies which adhere to the principles of accountability, fairness, transparency, and responsibility. The CG Manual, adopted by the Company during the financial year ended 31 March 2019 (“FY2019”), sets out the Group’s Corporate Governance Framework, Policies, Procedures and Standards (collectively the “Code”) and is premised on the Myanmar Companies Law 2017 (“Companies Law”) and the Company’s constitution (the “Constitution”). The Group remains committed to implement these practices consistently in all its business units and align with the regional corporate governance standards under the leadership of the Company’s board of directors (the “Board” or the “Directors”). The CG Manual is compliant with the Notification on Requirements for Effective Corporate Governance dated 3 December 2020 (“Notification 2/2020”) and the Instruction on Material Related Party Transaction for Listed Companies and Public Companies with more than 100 Shareholders dated 3 December 2020 (“Instruction 3/2020”), both of which were issued by the Securities and Exchange Commission Myanmar (“SECM”). The CG Manual and Code are subject to review from time to time. The CG Manual is available on the Company’s website.

FMI’s Governance Structure

Highlights of Governance Achievements

Ranked #2 in the Pwint Thit Sa

(Transparency in Myanmar Enterprises) Report 2023

YSX Listed Company Award 2020

Best Disclosure Practice Award

A Committed Member of the

UN Global Compact since 2012

SECTION 1 – BOARD MATTERS

The Board leads, controls, and is collectively responsible for overseeing the business and affairs for the long-term success of the Group. The key management personnel (the “Management”) remains accountable for day-to-day operations and administration of the Group, in accordance with the policies and strategies set by the Board. The Group has designated Chief Executive Officers (“CEOs”) for its business entities, who are responsible for their respective business units, whereby the CEOs will replicate the Board’s policies and strategies at the operations level. In support of this, the Board Committees (as defined below) have also been set up to ensure that there are reviews and checks and balances. In doing so, a framework of effective risk management is established, allowing for better assessment of the Group’s businesses.

Principal Duties of the Board

- to provide entrepreneurial leadership, and review and guide corporate strategies, annual budgets and business plans, giving consideration to long-term sustainable business growth;

- to set the Group’s vision, mission, goals, values, standards, strategies, policies and practices (including ethical standards), and to ensure that obligations to shareholders and other stakeholders are understood and met;

- to set strategic objectives and ensure that the necessary financial and human resources are in place for the Group to meet its objectives;

- to establish a framework of prudent and effective controls which enables risks to be assessed and managed, including safeguarding of shareholders’ interests and the Group’s assets;

- to oversee the internal control system including risk management policies and procedures to monitor and manage potential conflicts of interest;

- to ensure the integrity of the Group’s accounting and financial reporting systems are compliant with the law and relevant standards;

- to review the Management’s performance annually;

- to identify the key stakeholder groups and recognise that their perceptions affect the Group’s reputation, and to oversee the process of communications to engage with stakeholders;

- to consider sustainability issues, such as environmental and social factors, as part of its strategic formulation;

- to promote a high standard of corporate governance by ensuring timely and accurate disclosure on all material events regarding the Group;

- to strategise sound succession planning programmes for Directors and the Management are in place, and to create a process to reflect an adequate mix of individuals with relevant competence, industry experience and diversity of perspectives to carry out effective decision making are retained and nurtured in the talent pool;

- to ensure that every Director constantly keeps himself/herself apprised with the latest issues by attending relevant training;

- to ensure that all related party transactions (“RPTs”) and Material RPTs are handled in a prudent manner, with integrity and at arm’s length, and are reasonable in the circumstances, and in compliance with applicable laws and regulations to protect the interests of the Group’s shareholders and other stakeholders; and

- to ensure that all RPTs and Material RPTs be disclosed in a timely manner and be approved by the Board; and any Director who has a potential interest in the concerned RPT shall abstain from voting on the said matter.

Board’s Guidance on the Uncertain Economic and Business Environment in Myanmar

The business environment in Myanmar has experienced gradual recovery and growth over the past 12 months, particularly in the key urban cities where the Group operates. However, the operating environment remains challenging with the overall reduction in the macro economy, decreased foreign investment, USD availability, inflationary pressures, persistent electricity outages, import restrictions, and regulatory and policy changes. Despite these challenges, the Board remained focused on strengthening the Group’s core businesses and its financial position. In addition to prioritising the health and safety of our employees, the Board has also spent time looking at how the Group can continue to retain and develop local talents, recognising their importance to the future of the organisation.

Financial Management

The Group, under the guidance of the Board, remains focused in maintaining cost optimisation with reduced fixed overheads. With improved fundamentals in place, the Board expects opportunities to arise in the coming years which the Group will explore in a prudent manner.

Delegation by the Board

To assist the Board in carrying out its responsibilities and to strengthen the Company’s Corporate Governance Framework, without relinquishing its duties, the Board had formed three (3) committees, specifically, the Audit and Risk Management Committee (“ARMC”), the Nominating Committee (“NC”) and the Remuneration Committee (“RC”). The ARMC, NC and RC are collectively, referred to as the “Board Committees”, which comprise Independent and Non-Executive Directors only. Each Board Committee is guided by its own terms of reference to address its particular scope of work. All terms of reference are in the spirit of the CG Manual, approved by the Board and reviewed periodically to ensure their applicability in the ever-changing regulatory and governance environment.

Independent Judgment

All the Directors are guided to exercise independent judgment under the Companies Law, and to make decisions objectively in the best interests of the Company. No individual Director holds a considerable concentration of power in his/her professional capacity.

Board’s Strategic Review

The Board reviews and approves the Company’s strategic plans on a periodic basis. The Company has always believed that the real estate sector is one of the cornerstones for the long-term growth of the country. In 2022, the Company entered a landed housing market through the launch of City Villa@ StarCity. City Villa aims to offer affordable and quality housing units to middle income families and real estate investors. Continuously, in early 2023, the Company extended its City Loft Project to the West of Yangon with the launch of City Loft West, which consists of a land bank of 10.4 acres that lies parallel to the Hlaing River. The Company also strategically transformed its hospital sector into digital services through Heal App and expanded family clinics across Yangon, leveraging its experience from the pandemic.

Meetings

The schedule of all Board and Board Committees meetings and the Annual General Meeting (“AGM”) for each calendar year is planned in advance, in consultation with the Board. Board meetings are scheduled to be held at least four times for each financial year, with ARMC meetings scheduled to be held four times for each financial year or whenever the Board meetings are convened, to facilitate the review of announcements of the audited financial statements and management discussion & analysis, and the publishing of the Company’s annual reports and planning for the AGM. Additional key matters to be discussed at the Board meetings and ARMC meetings include financial performance, annual budget, corporate strategies and risk management, business plans, regulatory issues, and significant operational matters. Other Board Committees meetings, such as RC meetings and NC meetings are scheduled to be held once a year or whenever necessary, to review and evaluate the remuneration matrix and performance of each Director and the Management. Besides the scheduled Board meetings, the Board also meets to approve other material acquisitions and disposals of assets, and major commitments undertaken by the Company when the need arises.

The Constitution authorises the Board and Board Committees meetings to be conducted by telephone, audiovisual linkup or other instantaneous communication mediums. Directors who are unable to attend meetings physically would be engaged via audiovisual linkup. Due to the COVID-19 pandemic and various travel restrictions as implemented by the government authorities, majority of the meetings during FY 2023 were convened via audiovisual linkup. To further facilitate the efficient management of the Company, the Constitution also allows Board and Board Committees resolutions to be passed without a meeting being held if all of the Board and Board Committee members entitled to vote on the resolution and sign a document containing a statement that they are in favour of the resolution set out in the document.

A record of the Directors’ attendance at Board and Board Committees meetings for the financial ended 31 March 2023 (“FY 2023”) is displayed in the following table:

Directors’ Attendance at Meetings during FY 2023

| Board Meeting | ARMC Meeting | NC Meeting | RC Meeting | 31st AGM | |

|---|---|---|---|---|---|

| Total number of meetings held | 4 | 6 | 1 | 2 | 1 |

| Executive Directors | |||||

| U Theim Wai @ Serge Pun | 4 | N.A. | N.A. | N.A. | 1 |

| U Tun Tun | 4 | N.A. | N.A. | N.A. | 1 |

| Non-Executive Directors | |||||

| Prof. Dr. Aung Tun Thet | 4 | 5 | 1 | N.A. | 1 |

| U Kyi Aye | 4 | 6 | N.A. | 2 | 1 |

| U Than Aung | 4 | 6 | 1 | 2 | 1 |

| U Linn Myaing | 4 | N.A. | 1 | 2 | 1 |

| Mr. Cezar Peralta Consing1 (or his alternate, Mr. Alberto Macapinlac de Larrazabal) | 4 | N.A. | N.A. | N.A. | 1 |

| Mr. Jaime Alfonso Antonio Eder Zobel De Ayala2 (or his alternate, Mr. Alberto Macapinlac de Larrazabal) | - | N.A. | N.A. | N.A. | - |

1 Mr. Cezar Peralta Consing, nominated by Ayala Corporation resigned as the Non-Executive Director of the Company with effect from 27 February 2023. Concurrently with Mr. Cezar Peralta Consing’s resignation, his nominated Alternate Director, Mr. Alberto Macapinlac de Larrazabal also stepped down as the Alternate Director to Mr. Cezar Peralta Consing on the same date.

2 Mr. Jaime Alfonso Antonio Eder Zobel De Ayala, nominated by Ayala Corporation in place of Mr. Cezar Peralta Consing, was appointed as the Non-Executive Director of the Company on 27 February 2023. Concurrently with his appointment, Mr. Alberto Macapinlac de Larrazabal was appointed on the same date as the Alternate Director of Mr. Jaime Alfonso Antonio Eder Zobel De Ayala to carry out Mr. Jaime Alfonso Antonio Eder Zobel De Ayala’s duties, when he is not present.

Board’s Approval and Approval Matrix

The Company has prescribed internal guidelines for matters that require Board’s approval. For expenditures of MMK 5 million and below, the authorisation limits are granted to the Management. The Board has adopted a matrix in which Board’s approval is required for any matter that could impose or cause a material impact on the Company’s operations and financial positions as well as matters other than in the ordinary course of business.

Matters that specifically require Board’s approval include, but are not limited to the following:

- Group’s strategic plans and business focus;

- Company’s annually and half yearly financial statements;

- Acquisition, establishment, investment, divestment, or disposal of any subsidiary, business or asset of the Group exceeding the authorised limits of MMK 5 million;

- Restructuring or reorganisation of the Group’s business, entry into amendment, or termination of any joint venture or partnership requiring a capital investment on the part of the Company or any of its subsidiaries in excess of 10% of the Company’s total assets;

- Company’s annual budget;

- Dividend policy and payout;

- Appointment, resignation, and remuneration of Directors;

- Capital-related matters including capital structure, equity and debt instruments issuance and redemption of the Company;

- Taking up facilities, loans and incurring debts and/or lines of credit with banks and financial institutions and creditors;

- Reviewing and approving of RPTs, such as acquisition, disposal, the entrance of a new and significant contract with a related party;

- Approving matters within the ordinary course of business that exceed the authorised limits.

Conflicts of Interest

Prior to the appointment of each Director, every Director is required to make a declaration to the Board on any conflict of interest he/she may have with regards to the business operations conducted by the Company. Additionally, where a Director is subsequently conflicted or potentially conflicted or has any interest in any transaction, he/she will immediately declare his/her conflict of interest during the Board meeting and where applicable under the Companies Law, abstain himself/herself from participating in the deliberations, and subsequently voting on such transaction. This ensures that Board’s decisions are made in the best interests of the Company and all stakeholders.

Board Orientation

The Company conducts an induction programme for newly appointed Directors, assisting to familiarise the Directors with the Company’s businesses, Board processes, internal controls, and governance practices. It includes site visits, Management presentations on the Group’s businesses, strategic plans and objectives, meetings with the Management and briefings on key areas of the Group’s operations.

Board Training and Development

In addition to the development training, the Directors are encouraged to regularly attend training, conferences, and workshops to supplement and keep themselves updated with current market/industry information and to ensure continuous professional development at the Company’s expense. Since the Companies Law has come into effect in late 2017, the Company has arranged for Directors’ development programmes periodically, such as CG Awareness and Future Board Planning delivered by Myanmar Institute of Directors in June 2019; and Directors’ and Officers’ Duties under the Companies Law delivered by Baker McKenzie in September 2018. Directors are given necessary resources and are apprised on latest regulations by the Management with the assistance of CST (as defined below) to effectively discharge their fiduciary duties in a timely manner.

Access to Information

The Management acknowledges that it is pivotal to provide Directors with complete, adequate, and timely information prior to Board meetings for the Board to carefully consider the information, to make informed decisions, and to discharge their duties and responsibilities. In order for the Directors to have adequate time to prepare for meetings, the Board and Board Committees papers are typically circulated to Directors a week in advance of the meetings. Investment proposals made by the Management and the respective working teams are presented with background and essential information for the Board to evaluate and approve each investment. The Company has also adopted practices, such as allowing the Management to provide informal updates to the Directors on prospective deals and potential developments at the infancy stage before formal Board approval is sought. Specific personnel or third parties with expertise who are able to contribute to the discussions or to give opinions may also be invited to join the Board and Board Committees meetings to provide more information as and when needed. The Management also regularly engages the Board on business operations, industry outlook, and market sentiment to keep Directors abreast of the industry trends and market position. Directors are given full access to the Management, CST, the external auditor, and expert advice as and when needed at the expense of the Company.

Corporate Secretary Team

The Company also has a dedicated internal corporate secretary team (the “CST”) to promptly facilitate and fulfill ongoing corporate secretarial requests raised by the Directors. The CST is responsible for, among other things, advising the Board to disclose material information on a timely basis, maintaining and updating of all statutory registers, making statutory filings, and keeping corporate records as prescribed under the Companies Law, and to ensure that the Company is compliant with relevant rules and regulations prescribed by the SECM, the Yangon Stock Exchange (the “YSX”), and the Directorate of Investment and Company Administration (“DICA”). In addition to assisting the Chairman of the Board, the Chairman of each Board Committee and the Management in the preparation and circulation of the agendas for the various Board meetings, the CST also attends all Board meetings, prepares minutes of meetings, and assists to ensure effective coordination between the Board, the Board Committees and the Management. The CST facilitates and administers annual performance evaluation of the Board and management to assess the balance of skills and knowledge of the Board as a whole, as well as to identify the key areas of concerns and improvements that require the Board’s immediate attentions. The CST attends seminars and further professional programmes related to the corporate secretarial field as and when needed.

Board Independence

With more than 50% of the Company’s Directors considered Non-Executive or Independent, the Board is committed to maintain an environment of independence from day-to-day operations. Additionally, the diverse set of experiences and opinions brought in by the Non-Executive Directors helps to prevent the phenomenon of groupthink. Additionally, the NC requires each Director to declare his/her relationships with the Company, the Management and substantial shareholders in writing and reviews these declarations periodically to ensure that the Directors are not conflicted. While determining the independence of its Directors, the Company ensures compliance with the “Qualifications of Independent Directors” set out in Notification No. 90/2020 issued by the Ministry of Investment & Foreign Economic Relations. In accordance with the definition of “Independent” in the Company’s terms of reference for Board of Directors, which is disclosed in the CG Manual, inter alia, the Board may consider a director independent if he/she has not served for an aggregate period of more than twelve (12) years on the Board. In this regard, Prof. Dr. Aung Tun Thet, who serves the Board for less than twelve (12) years, qualified as an Independent Non-Executive Director.

Size and Composition of the Board

The Board comprises eight Directors, with one Independent Non-Executive Director, four Non-Executive Directors, two Executive Directors, and one Alternate Director. The Independent Director and Non-Executive Directors bring strong backgrounds in entrepreneurship and finance which allows for effective decision making. The Company benefits from a diverse range of objective perspectives with highly respected members of the community as Board members. The Compositions of the Board and Board Committees as of 31 March 2023 are set out below: –

| Name | Date of 1st Appointment | Last Re-election | Board | ARMC | RC | NC | |

|---|---|---|---|---|---|---|---|

| U Theim Wai @ Serge Pun | (EC) | 12 Sep 2004 | FY 2022 | Chairman | - | - | - |

| U Tun Tun | (ED) | 17 Nov 2009 | FY 2022 | Member | - | - | - |

| U Than Aung1 | (NED) | 31 Jul 1992 | FY 2023 | Member | Member | Member | Member |

| Prof. Dr. Aung Tun Thet2 | (ID) (NED) | 3 Dec 2013 | FY 2023 | Member | Chairman | - | Chairman |

| U Kyi Aye | (NED) | 5 Nov 2015 | FY 2022 | Member | Member | Chairman | - |

| U Linn Myaing3 | (NED) | 2 Jul 2012 | FY 2023 | Member | - | Member | Member |

| Mr. Jaime Alfonso Antonio Eder Zobel De Ayala4 | (NED) | 27 Feb 2023 | - | Member | - | - | - |

| Mr. Alberto Macapinlac de Larrazabal | (AD) | 27 Feb 2023 | N.A | Alternate | - | - | - |

| (EC) Executive Chairman (ID) Independent Director (NID) Non-Independent Director (ED) Executive Director (NED) Non-Executive Director (AD) Alternate Director | Assessment of Independence of Individual Directors All references to the independence of each individual Director are based on the CG Manual. |

||||||

1 U Than Aung retired and stood for re-election pursuant to Clause 16.14 of the Constitution of the Company at the 31st AGM held on 5 August 2022 (the “31st AGM”). The NC had considered his contribution and performance; and recommended to the Board to nominate his re-election at the 31st AGM.

2 By virtue of tenure of directorship, since the Company’s inception, Prof. Dr. Aung Tun Thet retired and stood for re-election pursuant to Clause 16.14 of the Constitution of the Company at the 31st AGM. The NC had considered his contribution and performance and recommended to the Board to nominate his re-election at the 31st AGM.

3 U Linn Myaing retired and stood for re-election pursuant to Clause 16.14 of the Constitution of the Company at the 31st AGM. The NC had considered his contribution and performance and recommended to the Board to nominate his re-election at the 31st AGM.

4 Mr. Jaime Alfonso Antonio Eder Zobel De Ayala was appointed as a Non-Independent Non-Executive Director of the Company on 27 February 2023 pursuant to Clause 16.7 of the Constitution of the Company. Shareholders’ approval on Mr. Jaime Alfonso Antonio Eder Zobel De Ayala’s appointment will be sought at the 32nd AGM to be held on 11 August 2023 (“32nd AGM”).

Board Diversity

The Company is strongly committed to foster diversity and inclusion on its Board to cultivate a diverse approach in business decision making, leveraging on the collective strength of its members who possess diverse abilities, knowledge, skills, and professional experiences which could contribute to spurring innovative thinking and sustainable competitive advantages for the long-term growth and success of the Company. The NC is tasked to assist the Board to review the structure, size, and composition (including the skills, knowledge, industry and business experiences, gender, age, ethnicity, tenure of service, and culture) of the Board and make recommendations with regards to any changes.

Indemnification of Directors and Officers

Since the financial year ended 30 September 2019 (“FY 2019”), the Company has purchased Directors and Officers Liability Insurance for the Board to protect individual Directors and Management against third party claim(s) as a result of any wrongful acts committed or alleged to have committed while acting in their capacity as Directors and Management.

Chairman of the Board

U Theim Wai @ Serge Pun is the Executive Chairman of the Company.

The Chairman of the Board plays an instrumental role in providing the Company with strong leadership and vision, assisting the Board in developing policies and strategies, and monitoring that these are implemented effectively, as well as to promote high standards of corporate governance. As the Chairman, he bears primary responsibility for the workings of the Board by ensuring effectiveness in all aspects of its role, including without limitation:

- setting the agenda for Board meetings with input from Management;

- exercising control over the quality, quantity and timeliness of information flow between the Board and Management to encourage constructive relations within the Board and between the Board and Management;

- promoting a culture of openness and debate at the Board;

- facilitating adequate time is allotted for discussion of all agenda items and strategic issues;

- observing the effective contribution of Non-Executive Directors; and

- playing a pivotal role in fostering constructive dialogue between shareholders, the Board and Management at the AGM and other shareholder meetings.

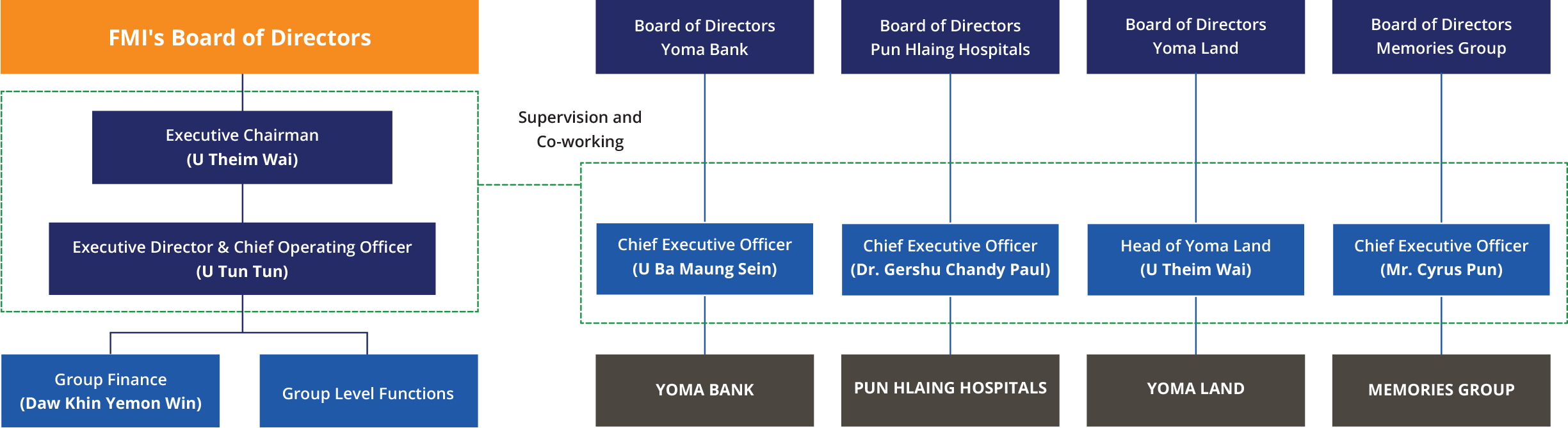

Role of the Chief Operating Officer (“COO”)

The Group entities are empowered to run day-to-day operations independently by having dedicated the Management teams led by designated CEOs who are responsible for each of its respective business units. Each designated CEO is accountable to run its business unit in accordance with respective Board and Board Committee policies. The COO is tasked to provide Group level support for infrastructure and executive decisions, work alongside and assist the respective CEOs, monitor the overall operations and resources, serve as the main point of communication between the Board and these CEOs, and establish company procedures after obtaining perspectives from the Board and shareholders. Effectively, the Company does not implement the traditional role of a “single CEO”, and the said role is spread over a number of top executives and CEOs of the business units in the governance model of the Company.

Management Structure for Business Units

NC Composition and Role

Prof. Dr. Aung Tun Thet (Chairman)

U Than Aung (Member)

U Linn Myaing (Member)

The NC comprises Non-Executive Directors only and is chaired by Prof. Dr. Aung Tun Thet, an Independent Non-Executive Director. It is regulated by a set of terms of reference supported by the Board, with duties and authority delegated by the Board. The NC works with the Board to determine the appropriate qualifications, skills, and experience for the Board as a whole and its individual members with the objective to create a diverse Board of individuals from financial sector, business, government relations, and academic. Any appointment or removal of a Director is subject to approval from the entire Board to develop and maintain a formal and transparent process.

The NC is tasked to regularly review the structure, size and composition (including the skills, knowledge, experience and diversity) of the Board and make recommendations to the Board with regards to any changes; and to ensure all Directors submit themselves for re-nomination and re-appointment at regular intervals. The NC further keeps under review the leadership needs of the Company including the succession planning for both the Management and the Directors, with a view to ensuring the continued ability of the Company to compete effectively in the marketplace. Please refer to the CG Manual for the detailed duties of the NC.

Re-nomination of Directors

The NC reviews annually the performance of each Director. When considering the nomination of Directors for re-election and re-appointment, the NC considers their contribution to the effective running of the Board, preparedness, participation, time commitments, whether proper attention has been given by the Directors to the affairs of the Company, and Directors’ other Board memberships at other organisations. In addition to that, the NC also determines whether he/she is independent in character and judgment, and whether there are relationships or circumstances which are likely to affect the Director’s judgement. The NC also monitors that all the re-nomination and re-appointment of the Directors are submitted at regular intervals. Directors are subject to re-election at least once every three (3) years in accordance with the Constitution that at least one-third of the Directors (including the Executive Chairman), for the time being, shall retire as Directors at each AGM of the Company. Shareholders are provided with relevant information on the candidates that are subject to election or re-election in the AGM’s Notice. During the 31st AGM, U Than Aung, Prof. Dr. Aung Tun Thet, and U Linn Myaing retired and sought re-election pursuant to Clause 16.14 of the Constitution.

Process and Criteria for the Appointment of New Directors

The Company adopts a holistic approach in the selection of new Directors. The NC is tasked to identify candidates and to review all nominations for the appointment, reappointment and termination of Directors and Board Committee members, taking into consideration of the Directors’ character and competence including integrity, reputation, capability, independence status, contributions during and outside Board Meetings, as well as other criteria prescribed under the CG Manual and additional relevant factors as may be defined by the NC. When there is a need to appoint a new Director, the NC utilises open advertisement or the services from external networks to select prospective candidates. During the selection process, the NC will: –

-

- review the existing composition and range of knowledge, expertise and skills in the Board and Board Committees;

- identify the Company’s needs and review the profiles of shortlisted candidates for nomination before sourcing for interview process;

- after the NC Chairman, Executive Chairman and other NC members interview the candidates, consider the candidates for appointment with an emphasis on the following to maintain the Diversity pledge of the Board: –

- A determination of the candidate’s independence;

- The candidate’s gender, age, cultural background, skills composition, industry and business experiences to complete the Board’s pledge to maintain a diversified Board; and

- The candidate’s character and reputation in the industry.

Directors’ Time Commitment

Despite the fact that some of the Directors have multiple board representations, the Board and NC examine carefully that these Directors have demonstrated their commitment and effectiveness fully in carrying out their duties and responsibilities as the fiduciaries in the best interests of the Company and avoiding potential conflicts of interest from representing on other Boards. The NC has adopted a guide that the maximum number of listed company representations each Director may hold is five (5). In determining whether each Director is able to dedicate sufficient time to carry out his/her duty, the contributions by Directors to and during meetings are also taken into consideration. Based on the Directors’ attendance at meetings held during FY Mar 2023, the NC believes that each Director has dedicated sufficient time and attention to the Company’s affairs; and has performed his/her duties effectively, and the Board held the view that all Directors had sufficiently discharged his/her duties, notwithstanding some Directors who held multiple representations on other listed companies.

Succession planning for Directors and Key Management Personnel

As the first company in Myanmar to be listed on the YSX, the Company recognises the importance of a succession planning process to remain prepared for the future. The Company strongly believes that succession planning serves as a tool in retaining talent, and the Management conducts regular reviews with all employees of the Company (“Employees”) to identify and nurture talent.

The Company recognises that succession planning is not a “one-size fit” and builds its succession planning based on the Group’s business direction. As such, the Group’s succession planning considers all ranks of the organisation and Employees at every level and not just its Board and Management. The Company considers key positions in the company to be equally critical as finding the “correct players”.

Extracted from Nominating Committee Guide 2012 issued by KPMG.

Extracted from Nominating Committee Guide 2012 issued by KPMG.

The diagram above provides an overview of the factors which are driving the need for board renewal and succession planning. As the business environment and business strategies change, companies need directors who have the right competencies to contribute to the Company and the board of directors. Amongst key considerations the Company takes into account are to: –

-

Identify required talent needs based on strategic business plans;

-

Determine required capabilities of critical positions;

-

Match competencies between the critical positions and identify employees to plug the gap;

-

Create high level development plan to grow selected employees; and

-

Assess and monitor performance.

With regard to succession planning of the Board, there is a process of refreshing the Board progressively over time so that the experience of longer serving directors can be drawn upon while tapping into the new external perspectives and insights of new appointees as part of the on-going Board review powers. With regard to the succession planning of the role of the Company’s CEO, FMI does not have the position of a Group CEO which concentrates the executive role to one (1) person. Instead, the Board has a general oversight over the CEOs at each business pillar and reviews the Group’s initiative on strategic development and direction on new investment. In addition to quarterly reviews on Employees to re-align goals, these reviews present an opportunity for the Company to engage Employees to establish their work patterns and career goals in order to develop the Employees’ potential.

Succession planning for Directors and Management is an important part of the governance process of the Board. Along with the Board, the NC plans the succession by shortlisting a supply of highly capable candidates within and outside the Group ready to assume the positions whether through an unexpected event or a planned transition. The Group believes that succession planning is vital to ensure continuity and leadership to help achieve its strategic objectives. The Group has been operating in Myanmar for over three decades and has been successfully and gradually migrated from the first-generation leadership to the current second-generation leadership over the past 10 years. In planning for succession, talent is constantly identified internally and externally to build strength and to serve as a pipeline for leadership succession planning. The Group has internally implemented a five year “work yourself out of a job” initiative which is a process that current leaders pursue higher and bigger scope of business while continuously giving rooms for young leaders to take up higher level of management roles. The Group also believes that its success today is driven by the depth and breadth of its leadership.

Since FY 2022, the Yoma Group has launched the Yoma Emerging Leaders League (the “YELL”), a leadership team consisting of 40 emerging leaders whom all already are in senior positions, with the aim to propel the growth of the Yoma Group over the next phase. During this period, it meets monthly with the Executive Chairman, a team of experienced executives, and guest speakers to network and brainstorm opportunities for cross collaboration between business units, and to leverage the full potential of the Yoma Group.

Board Evaluation Process & Criteria

The NC reserves its right to review the Board’s evaluation goals and update these goals if required, to ascertain the appropriateness in accordance with the needs of the Company.

Amongst the evaluation parameters of the Board reviews include: –

-

- Composition of the Board (consisting of a mix of competencies, varying experience, financial industry experience, risk management and remuneration expertise, qualification, diversity and transparency in the process of director search and appointment);

- Time commitment of the Board (assess the time commitment of directors who have multiple directorships and principal commitment to ensure each director devotes sufficient times to discharge his responsibilities);

- Structure of Board meetings (meetings held quarterly, number of meetings sufficient to meet commercial needs, the logistics and agenda, quality of the Board package, sufficient time allotted for each discussion, adequate inputs received from all Board members, the environment of the meeting to encourage free flowing discussions and debates without fear or favour, dissenting suggestions are welcomed and the Board minutes are recorded properly and approved);

- Governance of the Board (that the Board allocates adequate time to analyse and examine governance and compliance matters, including appropriate adjustments, ensuring the integrity of the Company’s accounting and financial reporting and systems, timely disclosures, reviewing of high risks issues and risk assessment);

- Stakeholder value (Board decision-making is adequate to assess creation of stakeholder value, existence of mechanisms to communicate and engage with various stakeholders, Board acting on a fully informed basis, in good faith with due diligence and care, shareholders and stakeholders are treated fairly;

- Board engagement with Management (Management is evaluated and monitored by the Board, review of remuneration of Management, and the Board and the Management have active access to each other and exchange of information);

- Board training (adequate orientation and professional development training is observed, continuing directors training, Board setting up a corporate culture and value, independent and non-executive directors);

- Evaluation on Board and Board Committees (recommend the process and criteria for assessing the effectiveness of the Board and Board Committees, and the contribution of each individual director to the effectiveness of the Board).

The Chairman of the NC and the ARMC, who is the sole Independent Director of the Company, will additionally provide his review annually on: (i) the performance of the Board as a whole; and (ii) assess the quality, quantity and timelines of information flow and dissemination between the Management and Board, that enables the Board to perform its duties effectively and reasonably. The NC is entitled to ask for any information necessary for it to discharge its responsibilities. This can include, for instance, comprehensive information on the background of Directors and checklists completed by Directors declaring their independence.

SECTION 2 – REMUNERATION MATTERS

RC Composition and Role

U Kyi Aye (Chairman)

U Than Aung (Member)

U Linn Myaing (Member)

The RC is appointed by the Board from amongst the members of the Board. It comprises Non-Executive Directors only. The RC considers and makes recommendations to the Board concerning the Company’s remuneration policy, level and mix of remuneration and procedure for setting remuneration. The RC ensures that remuneration arrangements support the overall strategic goals of the Company and enable the recruitment, retention and motivation of Directors and senior management personnel while also complying with any relevant rules and regulations. Please refer to the CG Manual for the detailed duties of the RC.

Remuneration Policy

1. Procedures on Setting Remuneration

The RC considers, develops, and maintains a formal and transparent procedure for setting Directors’ remuneration. In setting the remuneration, the RC ensures that the level and structure of remuneration offered is appropriate to the responsibilities undertaken and the level of contribution to the Company, while also taking into consideration pay and employment conditions within the industry and in comparable companies; and aligning the level and mix of remuneration with those of corporate and individual performances. Please refer to the Terms of Reference of the Remuneration Committee for the detailed duties of the RC. Upon deliberation, the RC forms its recommendations and submits them for endorsement by the Board.

The RC seeks expert advice and views on the remuneration of directors and executive officers (i.e., persons having authority and responsibility for planning, directing, and controlling the activities of the Company), where appropriate. The RC also refers to industry practices and norms while setting framework for remuneration whether it is appropriate to attract, retain and motivate the directors to provide good stewardship of the Company and executive officers to successfully manage the Company for the long-term. No Director is allowed to be involved in deciding his/her own remuneration.

The RC has the option not to grant incentives or to redeem incentive components of remuneration in any year if an executive Director or an executive officer is involved in circumstances of misstatement of financial results, or misconduct or fraud other than in the ordinary course of business resulting in financial loss to the Company. The executive Directors and executive officers of t he Company are remunerated on an earned basis and no termination and retirement benefits will be granted to their post-employment.

2. Level & Mix of Remuneration

The RC is tasked to review and recommend to the Board a general framework of remuneration (including but are not limited to directors’ fees, base/fixed salaries, variable or performance-related income, allowances, bonuses, stock options granted, share-based incentives and awards, and benefits in kind) for the Board and executive officers.

The remuneration packages for the executive officers comprise a fixed component (in the form of a base salary and where applicable, fixed allowances determined by the wider Yoma Group’s Human Resource policies) and variable components (made up of short-term incentives in the form of year-end bonuses and/or long-term incentives in the form of share scheme allowances) and other benefits-in-kind.

3. Disclosure on Remuneration

This Remuneration Policy will be disclosed on the Company’s website as well as in its annual/directors’ report. The total remuneration of employees who are family members of an executive officer (but not themselves an executive officer and whose remuneration level is equivalent to or more than that of an executive officer) are also disclosed.

Breakdown on Key Executives’ Remuneration for FY 2023

| Remuneration Band & Name of Key Management Personnel of the Group | Base/ Fixed Salary (%) | Variable Component or Bonuses (%) | Benefits-In-Kind, Allowance & Other Incentives (%) | Total | |

|---|---|---|---|---|---|

| Paid | Deferred | ||||

| MMK 100 million – MMK 170 million | |||||

| U Theim Wai @ Serge Pun U Tun Tun Daw Khin Yemon Win | 0% 91% 72% | 40% 9% - | - - - | 60% - 28% | 100% 100% 100% |

Breakdown on Non-Executive Directors’ Remuneration for FY 2023

| Fee (MMK) | Other Benefits | |

|---|---|---|

| Basic Retainer Fee | ||

| Non-Executive Director | 8,750,000 | Nil |

| Fee for Appointment to ARMC | ||

| Committee Chairman | 1,750,000 | Nil |

| Committee Member | 875,000 | Nil |

| Fee for Appointment to NC and RC | ||

| Committee Chairman | 1,312,500 | Nil |

| Committee Member | 875,000 | Nil |

SECTION 3 – ACCOUNTABILITY AND AUDIT

ARMC Composition and Role

Prof. Dr. Aung Tun Thet (Chairman)

U Kyi Aye (Member)

U Than Aung (Member)

The ARMC is appointed by the Board from amongst the members of the Board. It is chaired by the sole Independent Director and comprises Non-Executive Directors only. The ARMC plays a key role in assisting the Board in areas such as independent advice, assurance, and assistance to the Board on the Company’s risk, compliance, control, governance framework, and its external accountability responsibilities including in relation to financial statements. The ARMC reviews the half-yearly and annual financial statements of the Company before submission to the Board for approval, focusing in particular, on changes in accounting policies and practices, major risk areas, significant adjustments resulting from the audit, compliance with accounting standards as well as compliance with any stock exchange and statutory/regulatory requirements.

The ARMC directs and works with the Management to develop and review policies and processes to address and manage identified areas of risk in a systematic and structured manner in achieving the Board’s strategic objectives. The ARMC also oversees and advises the Board on the current risk exposures and future risk strategy of the Company. Under the Constitution, the ARMC generally undertakes such other functions and duties as may be required by statute or the relevant securities rules, and the Board by such amendments made thereto from time to time and require the attention of the ARMC. Please refer to the CG Manual for the detailed duties of the ARMC.

Accountability of Board and Management

The Board is ultimately accountable to shareholders regarding the management of the Company’s affairs. The Management recognises the importance of providing the Board with timely and accurate information and keeps the Board informed of any material developments. This ensures that the Board has the proper information to make informed decisions on the Company’s behalf. The Board reviews and approves the Company’s annual financial statements before they are released and aims to provide shareholders with a balanced and clear assessment of the Company’s financial position.

The Board reviews all decisions that may have a material impact on the Company’s financial position or earnings. In addition, the Board recommends the declaration of dividends for approval by shareholders, and approves the publishing of the financial statements, the acquisition or disposal of key assets and the nomination of Directors. The Board’s advice is sought on all key financial decisions, strategies, and projects with special attention given to the Board’s opinion on the impact of the Management’s decisions on the local community.

Internal Audit

Risk-based internal audit is one of the main functions carried out by the Group’s Risk Management to help the businesses accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes through the Enterprise Risk Management Framework, outlined as follows:

- Identifying potential risks inherent within the Group and external risks which the Group faces in the pursuit of its corporate objectives;

- Assessing and rating all the identified risks in a meaningful way in order for the Group to determine the extent of risks that it faces;

- Treating all identified risks, as far as possible, through established controls or pending control plans;

- Monitoring and updating any changes to the severity of the identified risks and any new risks that have emerged and

- Reporting key risks and the established controls (or pending controls plans) to the ARMC and the Board regularly.

Independent Auditor

The Company has engaged Excellent Choice Professional Limited (associated with CLA Global TS Public Accounting Corporation, Singapore) (“Excellent Choice”) as its Independent Auditor to audit the accounts of the Company and all its subsidiaries for FY Mar 2023. The report of the Independent Auditor is set out in the Independent Auditor’s Report section of this Annual Report. The Company adheres to Section 290: Independence – Audit and Review Engagements by International Ethics Standards Board for Accountants (“IESBA”) that an Independent Auditor shall refrain from providing non-audit advisory works to the same client and its related parties.

Release of Annual Reports

The Company strictly complies with the Securities and Exchange Rules that the Audited Financial Statements and the Annual Reports are released within 90 days from the financial year end with Statement of the Directors that the consolidated financial statements of the Company give a true and fair view of the financial position of the Company. Financial statements, the Company’s Annual Reports, and other price-sensitive information are disseminated to shareholders through announcements on the YSX’s website, the Company’s website, press release, and media briefings.

Whistle Blowing Policy

The Group is committed to achieving the highest standards of integrity and accountability within its internal structure. With this in mind, the Company has developed these procedures for reporting improprieties (the “Policy”) where Employees with serious concerns about the Company’s activities and operations may come forward and voice these concerns with the assurance that swift action will be taken if necessary.

This Policy is a direct and unambiguous statement of the Company’s commitment that any impropriety by the Company or any of its Employees, Directors, or Officers, once identified and reported, will be dealt with in an expeditious manner and thoroughly investigated and subsequently remedied. In fact, this Policy intends to empower Employees to raise potentially serious concerns within the Company rather than letting them escalate or possibly seeking alternative externally. The Company will also use its best endeavours to explore and implement policies to ensure that such impropriety can be prevented in the future. In the event that the whistle-blowing reports involve any Director, member of the senior management or the Non-Executive Director, the reports shall be escalated to the Chairman of Board, for his attention and further action as necessary.

The reporting mechanism invites and encourages Employees to act responsibly and impartially to uphold the reputation of the Company and maintain public confidence in it. Nurturing and developing a culture of openness and transparency within the organisation will further aid and expedite this process. Further background to this Policy and reporting mechanisms are explained on the Company’s website.

Related Party Transactions Policy

This Related Party Transactions Policy (the “RPT Policy”) aims to define RPTs and Material RPTs, and set out guidelines and categories that will monitor the review, approval, and ratification of these transactions by the Board and shareholders of the Company to ensure that all RPTs and Material RPTs have been identified and disclosed in the manner in accordance with the requirements of the Instruction 3/2020 prescribed by SECM and International Accounting Standard 24 (“IAS 24”) on Related Party Disclosures.

This RPT Policy applies to all RPTs and Material RPTs entered into between the Group and other related parties (“RPs”), to ensure that any transaction with a RP will be at arm’s length and on normal commercial terms that are not prejudicial to the Company and its minority shareholders.

The principal objectives of this Policy are to: –

- identify RPTs and potential conflicts of interest;

- set out the materiality thresholds for Material RPTs;

- approval of transactions below the materiality thresholds; and

- ensure proper approval, disclosure, and reporting of such transactions as applicable under the Instructions 3/2020 and Companies Law, between the Company and any of its RP in the best interest of the Company and its stakeholders.

Please refer to the RPT Policy in the CG Manual for details.

SECTION 4 – SHAREHOLDER RIGHTS AND ENGAGEMENT

Shareholder Rights

The Company is committed to deliver high standards of corporate disclosure through a transparent and non-discriminatory approach towards its communications with shareholders, the investment community, and the media. The Company has in place a communication system that discloses timely and complete financial data, and price-sensitive information to shareholders. Half-yearly releases of financial results and all other information including Management discussion and analysis are promptly announced on the websites of the YSX and the Company at https://fmi.com.mm/investors/announcements/ as soon as there are any changes. Press releases and analyst briefings are conducted whenever there is significant development, with the presence of key executives. The Company’s latest financial results, annual reports, and presentation materials for briefings are available on the websites for chronological review. There is also a specific webpage dedicated for investor relations with the Company’s share and financial information, which are disclosed on a timely manner. The contact details of the Company’s Investor Relations and general queries is as follows: –

Corporate Office

info-fmi@yoma.com.mm

+95 1 3687766

https://fmi.com.mm/

The Campus, 1 Office Park, Rain Tree Drive,

Pun Hlaing Estate, Hlaing Thayar Township, Yangon 11401, Myanmar

Conduct of General Meetings

The Company endorses active shareholder participation at its general meetings. Notices of AGMs and related information are delivered at least twenty-eight (28) days in advance. Detailed information of each item to be processed during the AGMs is supported with explanatory notes and guided instruction via both Burmese and English languages. Notices of AGMs are also advertised in the local daily newspaper, where notice handbooks and Annual Reports are send out to shareholders by social media. The general meetings of the Company are held annually at a central location that is convenient for public transportation. Shareholders who are unable to attend the AGMs in person are briefed to appoint a proxy to attend and vote on their behalf. Proxy Forms are required to be sent to the registered address of the Company not less than forty-eight (48) hours before the time of the commencements of the AGMs. On a show of hands, every Member present has one vote; and on a poll, every Member present has one vote for each fully paid Share held by that Member. Voting in absentia by mail, facsimile or email is generally not allowed to properly authenticate shareholders’ identity and their voting intention. Each resolution passed during the AGMs deals with only one single issue, where results of each AGMs are published on the YSX’s and the Company’s websites as soon as the event is adjourned. Shareholders are given the right to participate in decision making in affairs, including but are not limited to share allotment, share issuance, and amendment to the Constitution. The proceeding of each AGMs includes the business presentation delivered by the Executive Chairman and/or the COO to update shareholders on the Company’s overall performance over the past year. Shareholders are also invited to express their opinions and ask questions regarding the Company and the Group. The Directors and key executives in attendance address their concerns and queries responsively.

31st Annual General Meeting

In view of the ongoing COVID-19 transmission risks and political situations, the 31st AGM of the Company was held virtually and streamed live via http://agm.fmi.com.mm from the head office of the Company on 5 August 2022. Shareholders were guided to register their attendance and vote on the resolutions proposed for the 31st AGM by poll remotely, using the remote participation and voting facilities provided by the Company. Additionally, in the Company’s efforts to enhance its corporate governance, an external law firm, KST Legal, was appointed as the scrutiniser to count and validate the votes casted at the said AGM. Voting and vote tabulations (including votes cast for or against each resolution and the respective percentages) were announced on the websites of the YSX and the Company.

Dividend Policy

The Company has implemented a policy (“Dividend Policy”) which aims to provide a return to shareholders once a year through the payment of dividends after taking into consideration the Company’s financial performance, short and long-term capital requirements, future investment plans, and general business and economic conditions. The determination of dividend payment is at the sole discretion of the Board, which endeavors to maintain a balance between meeting shareholders’ expectations and prudent capital management. The Board will review the Dividend Policy from time to time and reserves the right to modify, amend, and update the Dividend Policy. In paying out the dividends, all shareholders should be treated equally and decisions on the declaration and disbursement of dividends shall be made by shareholders at the AGM upon recommendation of the Board. The Board has reviewed the Company’s strategic needs and plans for expansion and recommended no dividend shall be declared for FY 2023. Please refer to the CG Manual for the details of the Dividend Policy.

Corporate Values and Conduct of Business

The Company has employed a code of conduct (“COC”) for the Group that applies to all members of the Board, Management, and Employees. The COC sets the minimum standard that all levels of Employees are expected to mirror and comply with the spirit and principles of the COC, regardless of the jurisdiction or legal entity through which the Group operates. It also sets out the principles for employees in carrying out their duties and responsibilities to the highest standards of personal and corporate integrity when dealing with the Company’s stakeholders. Measures are taken to ensure full compliance with the COC, and breaches of this COC will result in disciplinary action. In observance of the Board’s commitment to maintain high moral standards which are central to the Company’s corporate identity and sustainable growth, the Company has also adopted the following corporate policies: –

-

- Anti-Bribery Policy

- Anti-Corruption Procedure

- Code of Conduct

- Conflict of Interest Policy

- Corporate Social Responsibility Approach

- Diversity Policy

- Employment Policy

- Environment, Health, and Safety Policy

- Human Rights Policy

- Land Acquisition Policy

- Practice on Reward for the Performance of the Company beyond Short-Term Financial Measures

- Professional Development Policy

- Related Party Transaction Policy

- Stakeholder Engagement

- Whistle Blowing Policy

These policies are accessible on the Company’s website at https://fmi.com.mm/governance/corporate-policies/. The Company prescribes relevant measures and procedures to mitigate the prospect of committing misconducts in the workplace; and require the acknowledgement and cooperation of the Company’s personnel from all levels including external parties representing the Group such as agents and intermediaries, consultants, business partners, and suppliers.

Managing Stakeholder Relationships

Along with other capital market players, the Company strives to enhance the investment atmosphere by engaging its shareholders, investors, and analysts through participating in investor expos, conferences and workshops locally and abroad, as well as continuously interacting with its investment community on social media platforms to communicate its value proposition and to seek investors’ feedback for improvements. The Company values its stakeholders and has pledged its support for the Ten Principles of the United Nations Global Compact. As exhibited in its Corporate Social Responsibility Policy, the Company along with the Group, take part in various community projects aiming to create value in the community it operates in.

As a pioneer and founding member of the Business Coalition for Gender Equality, the Company has been at the forefront of driving positive social change. The Company actively engages in various social impact activities, workshops, and conferences over the year to promote gender equality and empower women in Myanmar.

In addition to its involvement in gender equality initiatives, the Company takes proactive steps to engage stakeholders, particularly in its real estate projects. Recognising the importance of inclusivity, the Company organises stakeholder visits to ensure that the interests and needs of the community are taken into account. These visits provide an opportunity for stakeholders to witness firsthand the development projects, raise questions, share their feedback and fostering a sense of engagement and collaboration.

Employee Participation

The Company has policies and programs in place to strengthen its employee participation and engagement in the workplace. Please refer to the Company’s website on sustainability initiatives for more information on these engagement programs.

Shares Dealing

In accordance with the Section 55 (a) of the Securities Exchange Law of Myanmar, “any person shall not carry out any securities business without license.”1 Since the listing of the Company on the YSX in 2016, the Company has been actively engaging and encouraging its shareholders, who for various reasons, have not managed to transfer their shares smoothly from Special Accounts to Securities Accounts to utilise the electronic trading platform in an attempt to fully implement book-entry transfer system across the Myanmar stock market so as to keep abreast with the international standard. Annually, the Company is also submitting a list of insiders who has access to price-sensitive and confidential information to the YSX to avoid the possible breaches of insider trading. Internally, the Company has adopted a code of principles on securities dealings that the Company’s Directors, Employees and their family members are required to observe and adhere to for the time being that they are serving the Company, which are: (a) to observe and comply to insider trading guidelines prescribed by the SECM2 and to follow Securities Companies’ insiders examining procedures at all times when dealing Company’s shares; (b) to abstain from shares dealing while in possession of undisclosed material facts of the Company; and (c) to avoid selling their shares owned in the Company for the time being that they are serving the Company. All Directors and Employees are also required to report their dealings in the Company’s shares within three (3) business days.

Directors’ Interest in Shares or Debentures

The directors holding office as of FY 2023 had no interests in the share capital of the Company as recorded in the register of directors’ shareholdings kept by the Company, please refer to page no. 81 for detail information. –

List of Substantial Shareholders

Please refer to the table on page no. 149 for the ten largest shareholders of the Company as of 13 June 2023.

Substantial Shareholder above 5%

Please refer to the table on page no. 149 for the Register of Substantial Shareholders having an interest in 5% and above of the issued and paid up voting share capital of Company.

Prohibition of Insider Trading

In compliance with the Securities and Exchange Law and the Securities and Exchange Rule issued by Ministry of Finance, and the regulations issued by Securities and Exchange Commission of Myanmar, the Company strictly prohibits insiders such as members of the Board and employees in special positions with undisclosed material information related to business or financial situation of the Company from buying or selling securities for its own account or for other persons, disclosing or providing material information and giving advice to other persons to buy or sell securities based on unpublished material information.

The Board ensures from time to time that internal rules in place are reviewed and developed to prevent insider trading, and employees get the necessary training to protect insider information from accidental disclosures to the public.

Corporate Governance Manual